How has COVID-19 had an impact on consumer behaviour?

The COVID-19 pandemic is far more than a health crisis. It has forced governments, companies, and consumers to adapt to an uncertain health and economic situation. While we are still facing the pandemic, companies will have to adapt to consumers’ changing needs following periods of lockdown and amid fears of a global recession. What will become the new normal and what will companies need to do to meet consumer expectations?

A change in behaviour during quarantine

Consumers find comfort in what is familiar to them

During the pandemic: comfort in what is familiar

Before the pandemic, consumers were suspicious of large companies and questioned their intentions. They attached increasing importance to business ethics and their impact on society.

Figure 1: Before COVID-19, trust was an issue for the food and drink industry [1]

During the lockdown, consumers chose well-known brands that they considered comforting and reassuring.

On the other hand, during the lockdown, consumers chose well-known brands that they considered comforting and reassuring.

Consumers had two main concerns during quarantine and large companies were able to address these:

-

-

- Availability of products in shops

- Food Safety

-

In fact, 19% of American consumers stated that they were more likely to buy a brand that they knew for safety reasons [2]. And 36% of Brazilian consumers fear that the products they buy in shops may be contaminated [3].

Thanks to their resources and their supply chain, large companies are reassuring with regard to these two points. They were able to continue supplying shops and could ensure their products were available on the shelves. They are also perceived as having to follow strict regulations and are therefore considered more reliable when shelf life and food safety come to the forefront.

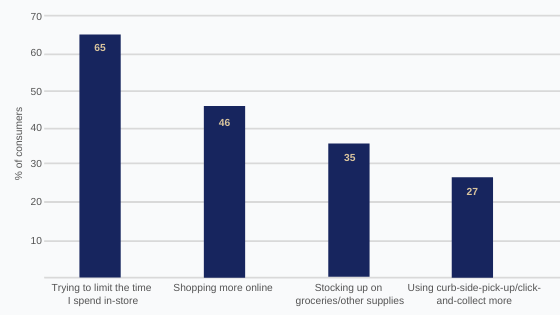

Less time spent in shops and growth of e-commerce

Consumers adapted their purchasing habits. They spend less time in shops and have increased their online purchases. For example, 56% of Chinese consumers of all ages now purchase their food items online [4].

Figure 2: changes in shopping habits in Canada [5]

As e-commerce is less conducive to discovering innovations, brands need to increase their online presence.

More time spent at home

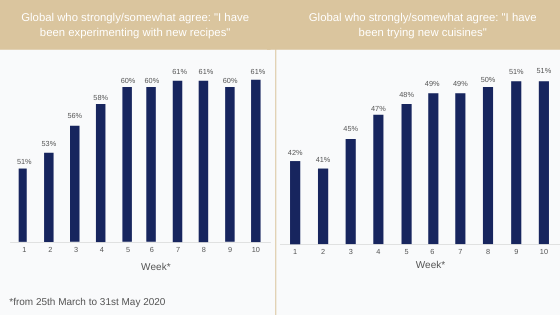

During quarantine, consumers adapted to an ‘at home’ way of life. Delivery services replaced out-of-home eating; exercise replaced the gym. Chinese consumers (47%) and Indian consumers (43%) say they spent more time working out at home [4].

Consumers, working from home, started cooking more. They were open to experimenting and trying new recipes.

Figure 3: Consumers have been experimenting when cooking [6]

What can we expect in the coming months?

An uncertain world

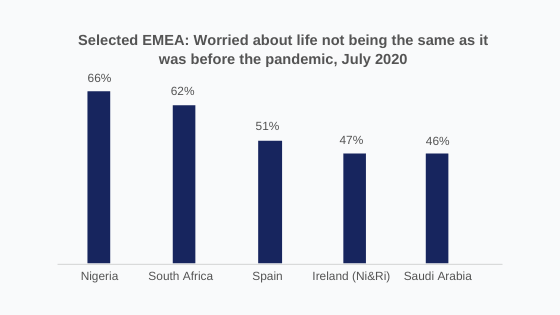

The new increase in the number of cases in certain countries, such as European countries, has led to new restrictions, plunging consumers into uncertainty.

Figure 4: In the face of uncertainty, consumers are worried [7]

Worry regarding the pandemic combined with concern for the economy has caused anxiety. Consumers are paying attention to their spending and are concentrating on basic necessities, value for money, and product safety.

New contact points to be found: the importance of digital

While consumers spend less time in shops, and many are working from home, brands need to find new contact points to communicate with their consumers.

Brands need to find new contact points to communicate with their consumers.

The growth in e-commerce is likely to continue for practical reasons, but also because it reduces non-essential trips outside of the home. It is therefore an opportunity for brands to develop their online offer.

Cooking more at home, which became a habit during the lockdown, is likely to continue. Consumers are experimenting and are looking for inspiration. Here again, there is an opportunity for brands to communicate by targeting consumers with cooking kits or by providing recipes online.

Changing consumer behaviour after COVID-19

Human well-being an important preoccupation

The pandemic, and the economic downturn that followed, have led to the well-being of people becoming more important than environmental concerns. Consumers want reassurance that companies are protecting their employees, taking care of their health, and paying them a fair wage. They are also taking a greater interest in how companies approach increasing world hunger in the context of the pandemic.

The pandemic, and the economic downturn that followed, have led to the well-being of people becoming more important than environmental concerns.

Corporate social responsibility is becoming increasingly global. It involves protecting employees, the community and fighting world hunger while protecting the planet.

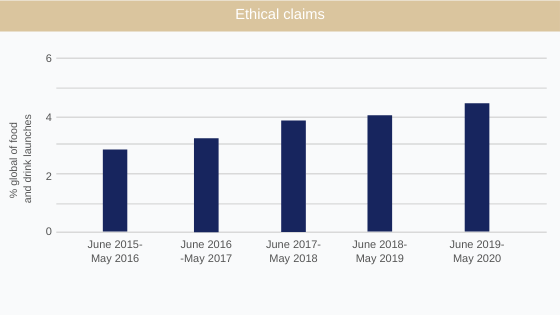

Figure 5: percentage of new launches with ethical-human claims, June 2015-May 2020 [8]

Towards ever more responsible consumption

The positive, visible impact of lockdown on the planet has brought the environment back to the forefront. Consumers do not want these positive effects to be wiped away by resuming economic activity.

The positive, visible impact of lockdown on the planet has brought the environment back to the forefront.

Figure 6: The pandemic has amplified environmental concerns [9]

Lockdown has fostered all things ‘local’. Although the pandemic is worldwide, many consumers paid more attention to the help that local communities and businesses needed. Local products are also considered to be more environmentally friendly.

To avoid wasting money, reducing waste will become increasingly important, both to protect the planet and in the context of an economic recession.

Consumer concerns regarding health have highlighted one of packaging’s main functions, the protection of food, at the expense of so-called responsible packaging. However, this issue should not be put aside as consumers who are concerned with sustainability will expect action to be taken in the future.

The importance of staying healthy

COVID-19 has highlighted both the importance of staying healthy and increasing concerns regarding diets that lead to bad health and weight gain. More than ever before, nutrition is considered part of a preventive approach to staying healthy.

More than ever before, nutrition is considered part of a preventive approach to staying healthy.

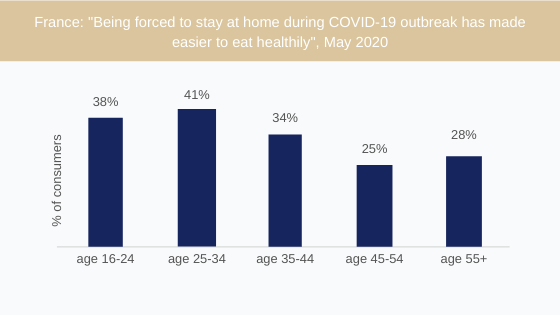

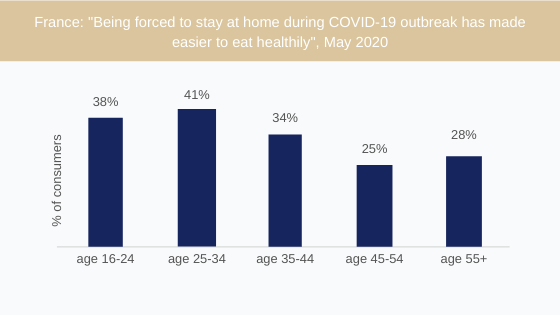

Figure 7: Young consumers are concentrating on their health [10]

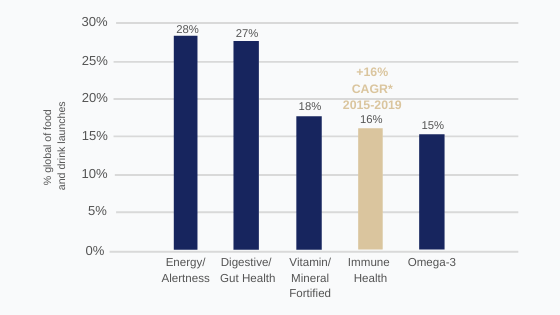

This awareness is leading to a change in eating habits, to eating less but better. Products with benefits for the immune system are popular.

Figure 8: Top claims as a percentage of food and beverage launches (Global, 2019) [11]

Does this mean the return of money-saving offers?

Consumers are more and more concerned about the economic crisis that seems to be on the horizon; prices will become an increasingly important consideration when purchasing food items.

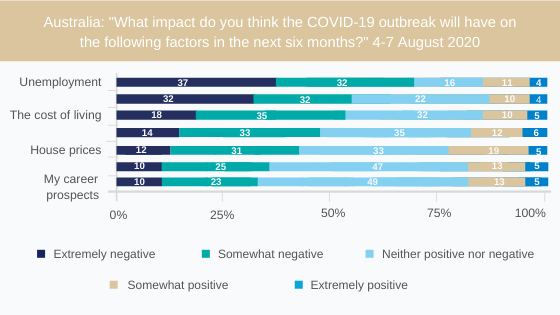

Figure 9: Consumers worried about the economic growth of their country and the cost of living [12]

In times of recession, offers for affordable luxury items often appear. During the 2008 crisis, Unilever launched mini Magnums at a price of €2–4 a pack, helping the brand to reach a turnover of one billion in 2012.

While consumers revalue the value of products in times of recession, companies will need to help them by communicating the facts and advising them on the overall value of the product, beyond price.

See our full range of dairy ingredients to help you innovate.

Sources :

[1] Lightspeed/Mintel, Base : US: 2,000 internet users aged 18+; France: 2,000 internet users aged 16+

[2] Lightspeed/Mintel; Mintel’s Global COVID-19 Tracker, Base: US: 2,000 internet users aged 16+, May 28-June 4, 2020

[3] Lightspeed/Mintel; Mintel’s Global COVID-19 Tracker, Base: Brazil: 1,500 internet users aged 16+, 28 May-15 June 2020

[4] GlobalData Covid-19 Weekly Tracker, Week 9

[5] Lightspeed/Mintel, Base: 500 Canadian internet users aged 16+, June 8-12, 2020

[6] GlobalData Coronavirus (COVID19) Tracker Survey Week 1-10

[7] Lightspeed/Mintel, Base: 1,000 internet users aged 16+ in each market

[8] Mintel GNPD

[9] Lightspeed/Mintel; Dynata/Mintel; Mintel’s Global COVID-19 Tracker, Base: Italy: 1,000 internet users aged 16+, April 29, 2020; Brazil: 812 internet users aged 16+, May 5-15, 2020; India: 500 internet users aged 18+, May 13, 2020

[10] Lightspeed/Mintel, Base: 2,000 French internet users aged 16+

[11] Innova Market Insights

[12] Dynata/Mintel; Mintel’s Global COVID-19 Tracker, Base: 500 internet users aged 18+