The Asian market: emerging trends in adult nutrition

Asia is confronted with an ageing population and consumer interest in healthier nutrition is increasing. These are social trends that shape tomorrow’s market in clinical and adult nutrition, creating a growing demand for products that support an active lifestyle and healthy ageing.

Increased senior and clinical nutrition needs

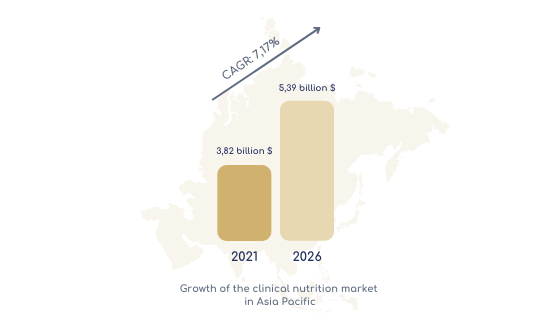

Estimated at 3.82 billion dollars in 2021, the clinical nutrition market is expected to jump by a further 7.17 % to reach 5.39 billion dollars by 2026

As one in five of the world’s seniors live in China, Japan ranking as the oldest country on the planet, and Southeast Asia preparing for an ageing population too, the need for specialized nutrition in Asia is rising. The number of people aged 60 and over is set to triple by 2050, and this growth-rate is creating medical challenges in the form of age-related malnutrition, increased cancer and nervous system diseases, and of course the simple wish to stay fit into later life. Higher protein intake is an effective response to all these needs. It is not for nothing that the healthcare industry has outpaced GDP growth in most Asian countries. Estimated at 3.82 billion dollars in 2021, the clinical nutrition market is expected to jump by a further 7.17 % to reach 5.39 billion dollars by 2026[1]. Other key factors also dynamize the market, such as the increased risk of metabolic diseases, the growing power of the middle classes, soaring health care costs and mounting knowledge of the long-term benefits of specialized nutrition[2].

The younger generations, spearheads of health nutrition

Interest in healthy snacks and healthy foods among younger adults is growing

The Asia-Pacific region is the world’s largest market for nutraceuticals, with China and India in the lead due to their demographic weight[3]. 19.17 % of the Chinese population is health-aware, compared with just 10.5 % five years ago[4]. This is still a low percentage, but is clearly evolving in the face of changing attitudes among the younger generations: 60 % of those who expressed an interest in healthy nutrition were in fact born after 1990[5]. More than 90 % of adults between the ages of 18 and 40 are familiar with the concept of a balanced diet[6]. Interest in healthy snacks and healthy foods among younger adults is growing, driven by active lifestyles that offer less time for meals than formerly, notably lunch[7].

In 2019, for example, there were 2 837 meal replacement brands in China, compared with 3 540 in 2020

This trend has a decided impact on the market: in 2019, for example, there were 2 837 meal replacement brands in China, compared with 3 540 in 2020[8]. Unsurprisingly, the Covid-19 pandemic has also helped to refocus the attention of young adults on their health and immune system as well as the need to adopt a healthy lifestyle[9]. Food industry promotional campaigns that are targeting the Asian market and the preventive-measures and health-education market (the latter estimated at some 205 billion dollars), have a fertile environment for developing opportunities in healthier foods designed to reinforce general health and the immune system. Lactalis Ingredients offers a range of native proteins for adult nutrition: Pronativ® Native Whey Protein and Pronativ® Native Micellar Casein. These are produced directly from milk using a gentle non-denaturing process that keeps the proteins intact. The functional and nutritional benefits of Pronativ® proteins make them the perfect solution to the new needs outlined above.

References:

[1] Asia Pacific Clinical Nutrition Market Research Report – By Product Type, Therapeutic Areas, Ingredients Type and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) – Industry Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast (2021 to 2026). Market Data Forecast, January 2022.

[2] Zheng Qunyi, “Opportunities and Challenges in the Health and Nutrition Industry with the Rise of Younger Consumers” in Transition and Opportunity, pp 229-237, Springer 2022.

[3] Dublin Business Wire, op. cit.

[4] Statistics from the Chinese National Health Commission .

[5] Report on Interest in the Health Products Industry 2019 (Deloitte).

[6] Herbalife Nutrition Report with the NGO Feed the Children, 2021.

[7] CBN Data Report “2020 Meal Replacement and Light Dinner Consumption Insight”.

[8] Dublin Business Wire, “Global Nutraceuticals Market Analysis: Plant Capacity, Production, Operating Efficiency, Technology, Demand & Supply, End-User Industries, Distribution Channel, Regional Demand, 2015-2030”.

[9] Zheng Qunyi, op. cit.